Lease

Lease

Lease Or Buy - What Are My Options?

Leasing vs Purchasing

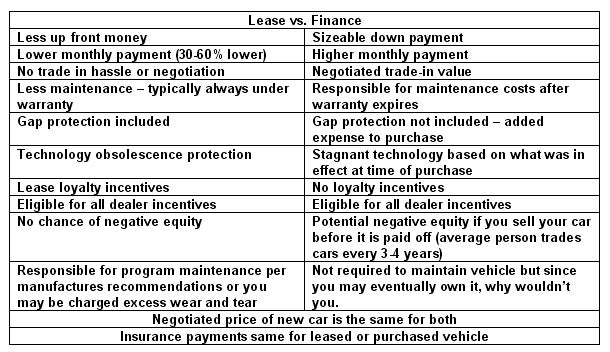

A lot of questions come up when looking for a new car; one of the biggest ones is should I buy or lease the car. Although leasing and purchasing are different, you cannot really say one is always better than the other. Each has their own benefits and drawbacks and is best to educate yourself to see which one is best for you.

Simply put, leases and purchase loans are two different methods of automobile financing. A lease finances the use of a vehicle; the other finances the purchase of a vehicle. Below, you will find out which option is best for you. Purchase or Lease, our Dalton Subaru Finance Department serving San Diego will walk you through the process.

Buying | Leasing: Difference

When you buy you are paying for the entire cost of own the vehicle, regardless of all the miles you will drive. You will more likely make a down payment and pay sales taxes in cash or roll them into the loan. After you sign your contract you'll make your first payment a month later with an interest rate determined by your loan company. Later, you may decide to sell or trade in the vehicle for its depreciated resale value. Usually, at the end of a typical 5-6 year loan chances are that you really wanted to trade it in a year ago or earlier. Unfortunately vehicles are a depreciating asset that loses its value over time, some faster than others. So at the end of a loan you'll own a car you really don't want and isn't worth very much when you trade it in. However the pride of ownership is important to many consumers and makes buying a no brainer.

In the other hand, when you lease, you pay only a portion of a vehicle's cost; since it will be the only part you "use up" during the time you drive it. You'll have the option of not making a down payment, your sales tax will only be of your monthly payments, and you'll pay a financial rate (money factor), that is similar to the interest of a loan. At the time of signing your contract you will have to make your first payment for the month ahead and may be required to pay bank fees you don't usually pay when you buy. At the end of the lease you will have three options regarding the disposition of the vehicle:

- Keep the car. And pay based on the guaranteed future vale (GFV) established when you originally leased the car.

- Sell or trade the car. If the value of the car is actually HIGHER than the GFV, you can sell it or trade it and keep the profit

- Walk away. Why keep a car that is valued less than the GFV. At that point you can lease or purchase another vehicle

Buying | Leasing: Example

For example, if you lease a $25,000 car with a residual value of 50% 05 $12,500 after 36 months you only pay for the $12,500 difference (this is called depreciation), plus finance charges, plus possible fees.

When you buy, you will pay the entire $25,000, plus the finance charges, plus possible fees, plus the entire sales tax amount. This is technically why leasing offers have lower monthly payments than buying.

Some of you may think to lease with the intension of buying the vehicle at the end or before the end of the lease. Unfortunately leasing a vehicle with the intent of buying it at the end is almost ALWAYS more expensive than purchasing the vehicle over the longest possible term (72 months). This has to do with the residual value at the end of the lease that was predetermined at the beginning of the lease when the vehicle is almost always higher than the actual value of the car. Which happens to benefit you in the beginning: Higher Residual value = Lower payments.

To summarize, leasing typically does not build ownership equity, while buying does. The reason that a buyer has equity at the end of his loan is that he purchases that equity by making higher monthly payments. Part of each payment funds the equity. Leasing = lower payments, no equity. Buying = higher payments, partial (and declining) equity.

Leasing: Mileage matters

Subaru leases are typically 10,000, 12,000, or 15,000 miles per year but can be customized up to 30,000 miles. So if you have a predictable lifestyle and driving habits you can usually estimate your annual mileage, and if your annual mileage falls within these parameters, Leasing is a viable option. However if you exceed the allowed miles at the end of the leases, expect to pay .15 per mile overage fee. This is why it is important to know how many miles you expect to drive a year.

Buy | Lease: Early Termination

If you want to terminate your purchasing of a vehicle early you will have to either sell it privately or trade it in. Usually resulting in negative equity (owing more than the value of the car)

If you want out of a lease early, you may be stuck. However, several fee-based Web sites, including LeaseTrader.com and Swapalease, match people who want to get out of a lease early with those who want to assume a short-term lease. At LeaseTrader.com you pay a small fee of $90 to post your vehicle and $150 to complete the transfer of the lease.

Buy | Lease: GAP Insurance

Subaru leases all have built-in GAP insurance, while most car purchase loans don't. GAP insurance pays the difference between what you owe on the loan or lease and what your vehicle is actually worth if your car ever gets stolen or is totaled in an accident. It is very important because it is common to owe more on your loan or lease than your car is actually worth; which can mean you still owe hundreds or thousands of dollars to the finance company even after your insurance has paid for totaled or stolen car. So, Subaru leases have built-in gap protection, but loans do not. You're better protected with a lease, unless you purchase the gap insurance separately at extra cost for the loan.

Buy | Lease: Which is better?

As with any question of this type, there are always pros and cons, advantages and disadvantages:

You Should Lease

If you enjoy driving a new car every 3 or 4 years, want lower monthly payments, enjoy having a car with the latest technology, safety, always under warranty, have a stable predictable lifestyle, drive and average number of miles, properly maintain your cars, willing to pay more over the long run to get benefits and understand how leasing works.

You Should Buy

If you don't mind higher monthly payments, prefer to build up some trade in or resale equity (value), l enjoy having ownership of your car, prefer paying off your loan and being payment free for a while, prepared for the unexpected cost of repairs after the warranty has expired, drive more than average miles, prefer to drive your cars for years to spread out the cost, like to customize your cars, expect lifestyle changes in the near future, and don't like the risk of possible lease-end charges.

| Monday | 8:00AM - 8:00PM |

| Tuesday | 8:00AM - 8:00PM |

| Wednesday | 8:00AM - 8:00PM |

| Thursday | 8:00AM - 8:00PM |

| Friday | 8:00AM - 8:00PM |

| Saturday | 8:00AM - 8:00PM |

| Sunday | 10:00AM - 6:00PM |

| Monday | 7:00AM - 6:00PM |

| Tuesday | 7:00AM - 6:00PM |

| Wednesday | 7:00AM - 6:00PM |

| Thursday | 7:00AM - 6:00PM |

| Friday | 7:00AM - 6:00PM |

| Saturday | 8:00AM - 5:00PM |

| Sunday | Closed |

| Monday | 7:00AM - 6:00PM |

| Tuesday | 7:00AM - 6:00PM |

| Wednesday | 7:00AM - 6:00PM |

| Thursday | 7:00AM - 6:00PM |

| Friday | 7:00AM - 6:00PM |

| Saturday | 8:00AM - 5:00PM |

| Sunday | Closed |